New York State W 4 2024 Form – A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer taxes and remit the taxes to the IRS and state and local authorities (if applicable . We are constantly being asked by new hires for help completing their Form W-4. I have been advised by our labor attorney that I should never help my employees fill out this paperwork. Is this really .

New York State W 4 2024 Form

Source : www.tax.ny.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comEmployee’s Withholding Certificate

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.com2024 Form W 4P

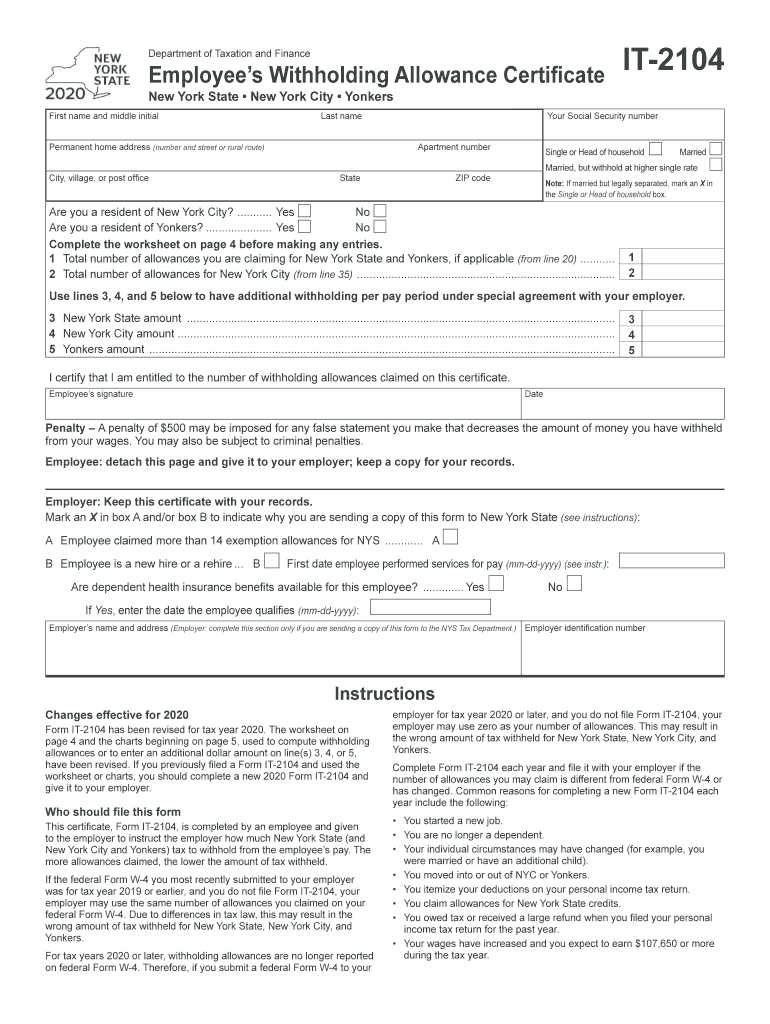

Source : www.irs.gov2022 2024 Form NY DTF IT 2104 Fill Online, Printable, Fillable

Source : it-2104-form.pdffiller.comInstructions for Form IT 2104

Source : www.tax.ny.govNys withholding form: Fill out & sign online | DocHub

Source : www.dochub.comNew York State W 4 2024 Form Form IT 2104 Employee’s Withholding Allowance Certificate Tax Year : This guide will cover the steps you’ll take to form a New York limited liability company, explain state specific requirements Prepare an LLC Operating Agreement #4: Fulfill the New York . New York state income taxes are also due on April 15 Reclaim your exemption from withholding by filing a Form W-4 by Feb. 15. This would be filed if you anticipate having no tax liability .

]]>